Thu 05 / 01 / 23

How to approach pricing: inflation, recession and planning

Getting your pricing right can be hard - especially with the rising costs of living, and a recession on the horizon. Rhys Dyke, Partner at Galloways Accounting, shares a model for getting your pricing right, plus how to approach pricing for inflation - or a recession.

By Rhys Dyke of Galloways Accounting

There are a huge number of approaches to pricing. There are shelves of textbooks out there, but we’re going to work with the one of the simplest approaches: break even analysis.

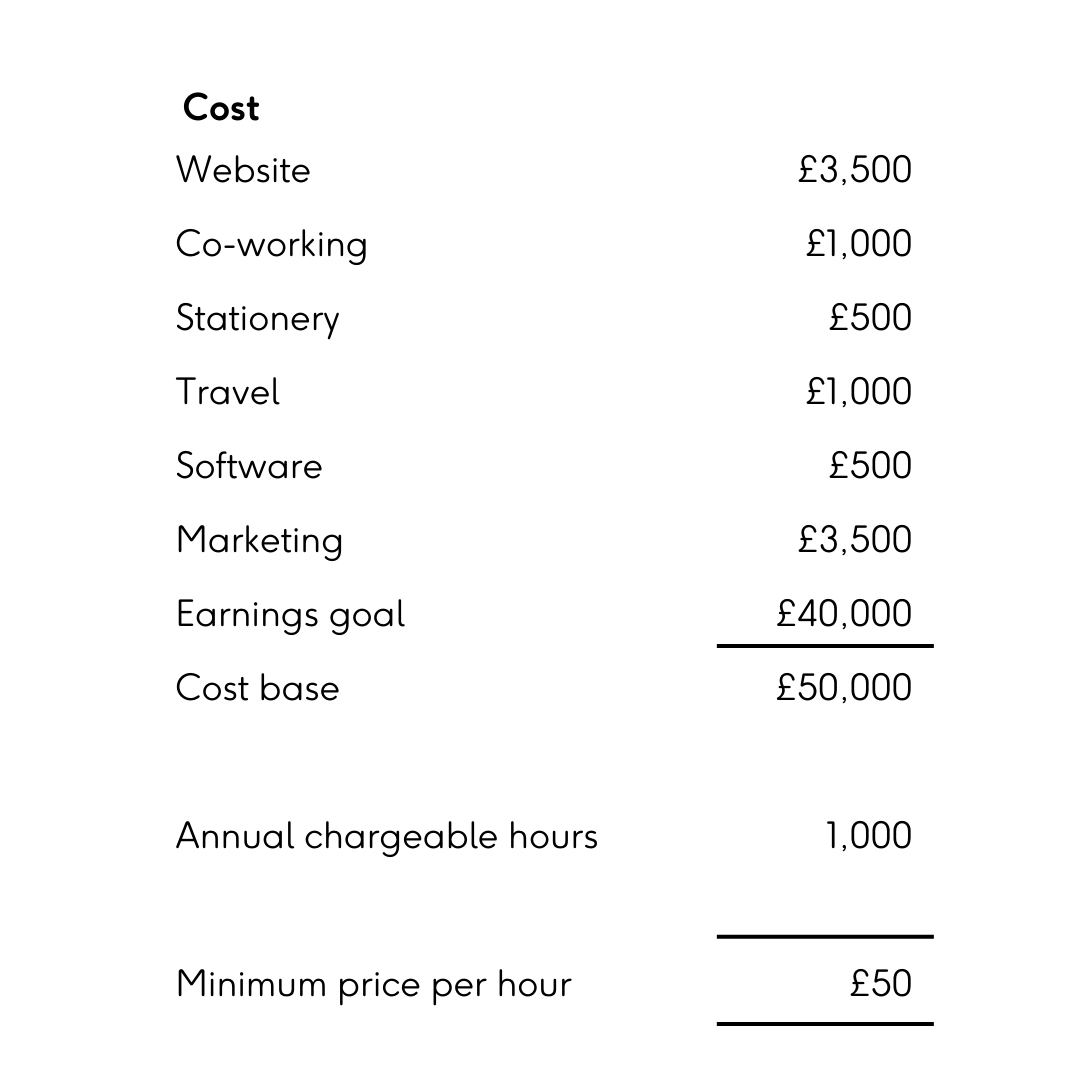

The underlying idea is that we take all our known costs, including your expected earnings, then divide that ‘cost base’ across our expected output. Let’s work through a straightforward example below for a self-employed consultant who bills their clients by the hour.

By understanding your cost base and having a reasonable expectation of your output, in this case chargeable hours, we know how we need to price each ‘unit’ of activity to ensure that break even for the year.

This approach means that we must have a good understanding of costs and we have a realistic expectation of our output. This second point is particularly relevant when you’re selling time - as a small business owner, you’ll have a huge number of other obligations.

It’s not a surprise that bringing in more business will help offset your cost base, which will allow you to control prices. This is easier with commodities than selling hours. If you’re in a knowledge-based industry and work by the hour, you’ll hit a point where you’re maxed out, and therefore will need to look at bringing in additional support. Approaching consultants may keep it more flexible here, especially if you’re work is project based and non-recurring.

If you’re part of a bigger business, motivating your team with financial incentives that are linked to the financial performance of the business (bonuses or, even better, long-term equity-option plans) may help increase their output, align your goals, and limit the impact of inflation on your cash flow and profitability.

Pricing for inflation or a recession

With prices increasing, anything you can do to drive down costs is going to help but it’s essential that you focus on costs which don’t limit your ability deliver to your customers; don’t restrict your ability to supply or you’re going to limit your output and restrict revenues.

The key to this is being honest with yourself. I suggest an exercise in reviewing your cost base to make sure you’re splitting the essentials from luxuries, ego or ‘would like to have’ costs. You may not need to pull these, but if you do, you may need to act quickly, Having them lined up in advance is going to allow for quicker action.

Automation and the range of amazing software in the market can really help you find cost effective solutions to solve all manner of business issues.

How to approach changing prices with your customers

Despite my pushing automation, nothing will ever replace leading with a person-centric approach. Being human and sharing a coffee with customers before you move your pricing will help them accept the higher costs and stay loyal to you – it gives you the ability to remind them of the amazing value you provide.

In these meetings, be up-front with customers about price increases as it’s not a dirty part of the relationship to address in the last few minutes of a meeting. Do it first, so you can dedicate more time on the relationship aspect.

Don't ever let regular customers find out they're paying more when they go online to order, or worse, when an invoice arrives.

Future planning in relation to pricing

It’s always better to have a plan to be ahead of the curve before any impact hits. Forecasting and some ‘what if’ analysis will help your decision making and improve your response times at crunch points.

Have a strong, open relationship with your suppliers. This should let you know how and where you can negotiate and where your red lines need to be. They are likely to be in the same boat as you, so renegotiate contracts and terms early and be tough – but human.

There are usually discounts out there if you’re willing to pre-order, pay early or buy in bulk.

When reviewing your finances or building your forecasts, having a trusted adviser to bounce ideas around with and challenge some of your assumptions can be valuable.

Rhys Dyke is a Partner at Galloways Accounting. Find out more about Galloways on their website here.

If you want to contribute to the Chamber blog, contact us on hannah@brightonchamber.co.uk